Just last year, retail eCommerce sales were an estimated $4.9 trillion worldwide. Over the next four years, it’s predicted to grow by 50% and reach almost $7.4 trillion by 2025.

Seems like a goldmine for eCommerce businesses, right?

Well, there are also anywhere up to 24 million online stores — and the number is steadily growing every single day.

It’s becoming more and more important for online businesses to find innovative solutions to stand out from the crowd. One recently popularized strategy is product matching.

This strategy is used to elevate the customer’s buying experience and stay competitive with other similar businesses.

Read on as we discuss everything you need to know about product matching in eCommerce and how it can be beneficial for both you and your customers.

What Is Product Matching?

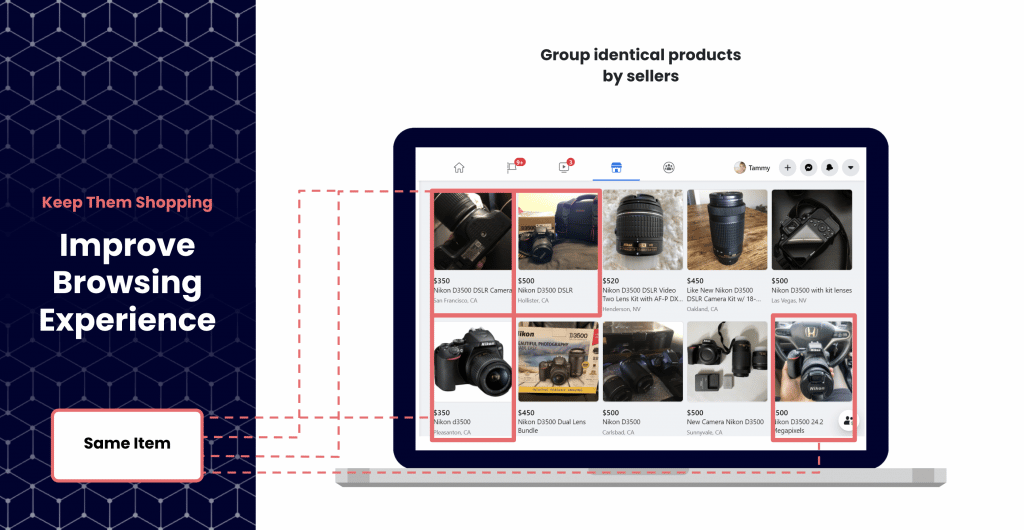

Product matching is the term used in eCommerce when the same products are offered by different sellers in a single search result. This is done with the help of deep learning and a product matching algorithm.

To give you a better understanding, let’s take a look at the landscape of eCommerce right now. When people go shopping online, they’ll land on one of several different eCommerce platforms (whether they know it or not).

Some of the most popular platforms include:

- Magento

- Squarespace

- Shopify

- WooCommerce

- Elementor

- Wix

- 3DCart

Right now, more than 1.7 million merchants sell products on the Shopify platform. In 2020, Shopify processed more than $5.1 billion in sales.

With this in mind, it’s very likely that certain retailers are selling their products on several different eCommerce spaces throughout the internet. In other words, identical products are offered by different sellers on the same platform.

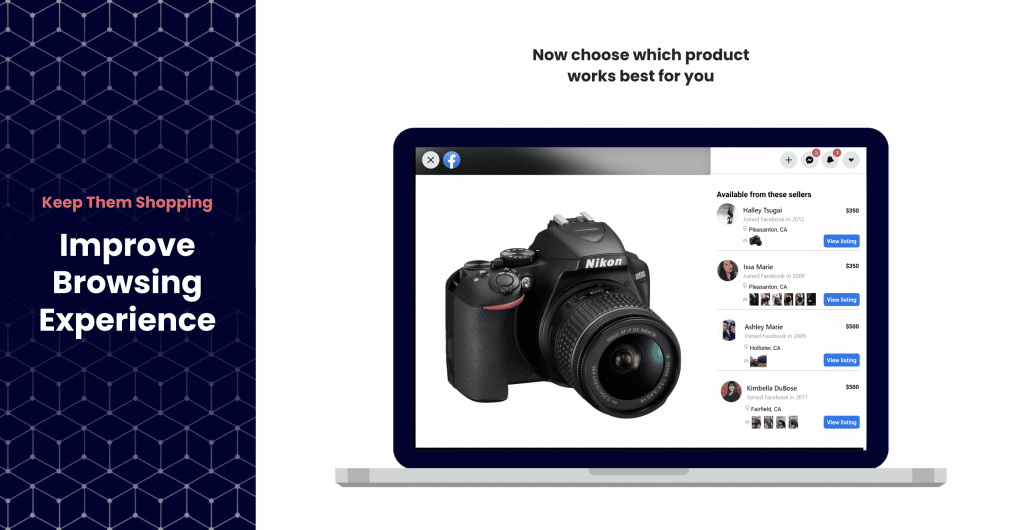

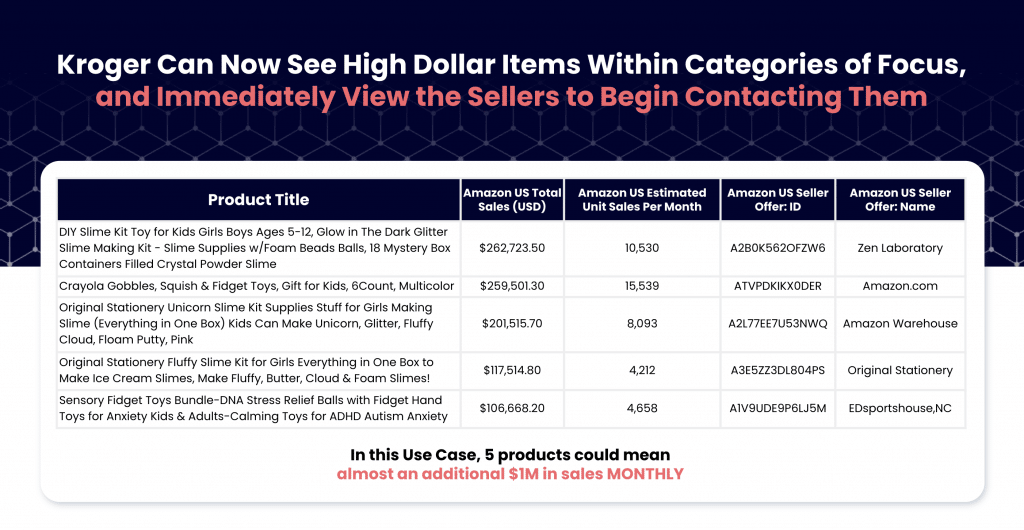

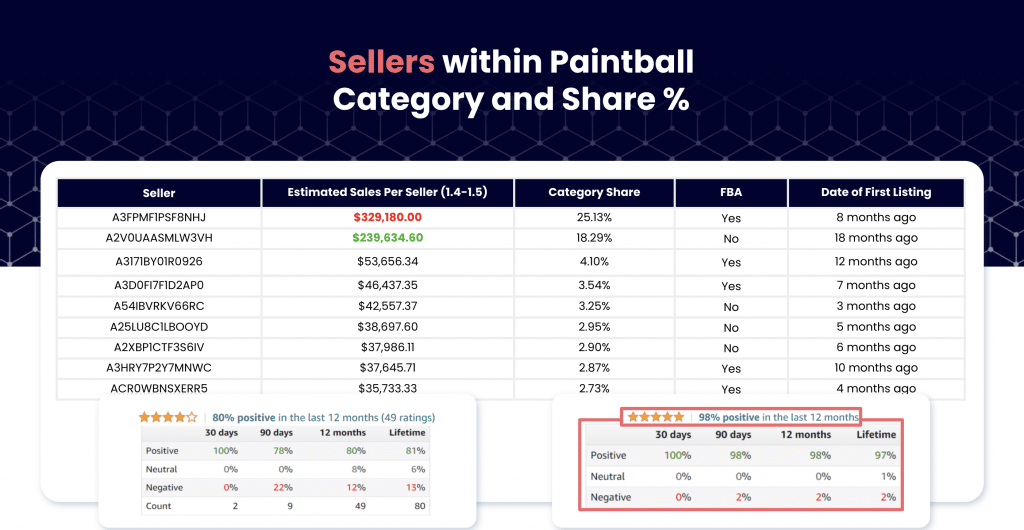

Through digital product matching, a seller can search for a product and see the same product being sold by the different sellers. From there, they can compare the price, quality, and other attributes, then make an informed decision to buy.

It’s like wanting to buy a new phone and walking into several different stores to see who has the best offer. The only difference is that you can do this online quickly and easily through matching products.

How Product Matching Benefits Both Sellers and Buyers

Product matching solutions are important for both the sellers and buyers in a transaction.

For the buyers, it creates an opportunity to compare several different options and choose the offer that works best for them. It’s more sophisticated than just choosing the lowest price, too. Let’s look at an example.

Let’s say a shopper is in the market for a new Bluetooth speaker. Two sellers are offering the same speaker for $50. However, another seller is offering the matching product for $55, but also offers a free one-month subscription to Spotify (a music streaming service).

Depending on if he or she is in the market for a streaming service as well, the second, more expensive option might be more attractive to our buyer than the first two options. If the first two are more attractive, the buyer can go deeper and take a look at the company, shipping costs, quality, etc.

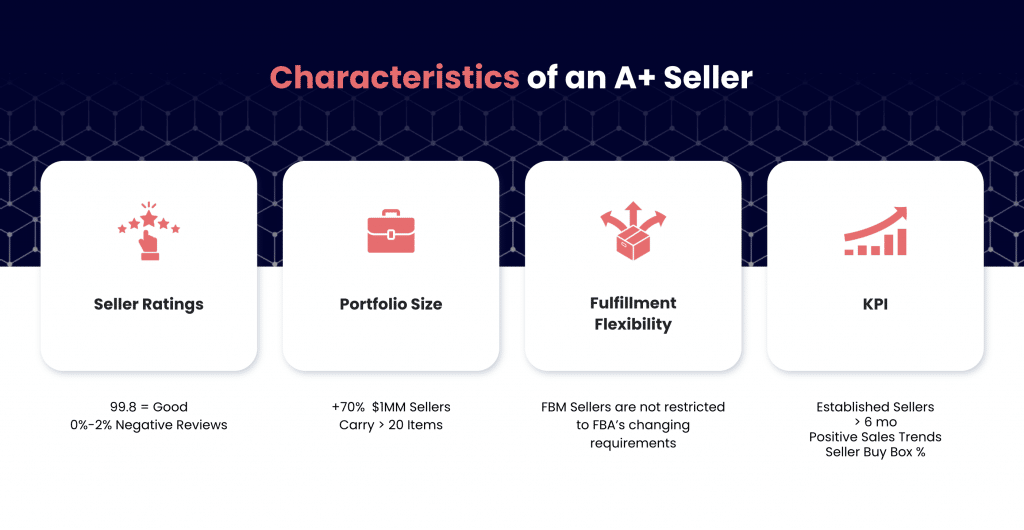

Product matching is also helpful for sellers, too. It can be used to develop a pricing policy and keep them competitive with other businesses over time. They can easily learn about their competitors and figure out new strategies on how to stand out from the crowd (like offering a free month of Spotify).

It’s also important when they start building their offer, as well. They need to figure out how to name the product, what images to use, and what kind of copy they should write to describe the product.

For these reasons, product matching is incredibly useful for both parties involved.

Other Useful Benefits of Product Matching

Other than helping customers find the right products and sellers to compare their wares, product matching has other benefits as well.

Let’s take a look at a few.

Relevant Product Recommendations

Businesses can take advantage of product matching by simply suggesting related products to customers that are shopping online.

For example, let’s say that a customer is shopping for a new guitar online. He finally finds the perfect guitar and adds it to his shopping cart.

Through product matching, the system automatically recommends an amplifier and a cable to go along with it. The recommendation is just what he was looking for, so he purchases both products.

This can make product matching a powerful cross-selling tool.

Improve Product Listings

Through deep learning and name-matching machine learning, you can improve how your products are listed on your website.

The system’s analytics can help you learn more about your customers’ behavior, which will help you understand how to better rank products on your website.

For example, you can take a similarly matched store to your own and analyze their listings. The algorithms will give you insights into how your products are titled and described. This can help you find gaps and shortcomings in your product pages. For instance, you may find a certain page is missing vital keywords that could help you rank higher in SEO.

Detect Copyright Infringement

Most businesses spend tons of money and resources building their brand identity and designing a unique strategy. This applies to their visual content, the copy on their product pages, and the designs used on the website.

This is why it’s important to keep a close eye on copyright infringement. Through product matching, you can detect cases when other businesses are illegally stealing your designs.

Establish Competitive Prices

As mentioned above, product matching is an invaluable tool when it comes to forming product pricing. Through deep learning, you can automate pricing analysis not only when you first set prices, but over time as trends change.

Machine learning can lead to an increased profit that can’t be achieved through manual solutions effectively.

Get Real-Time Data Through Product Matching

Product matching is an invaluable tool that can help both retailers and their customers have top-notch experiences when they shop online.

Sellers can save time and get a positive ROI by utilizing deep learning to optimize their stores.

If you’re ready to start growing your store with the most accurate cross-channel eCommerce data in real-time, book a demo with us today!